Your Money Mindset™

This course in a nutshell:

In 50 days, create a peaceful, easier relationship with money by shifting your mindset, feel confident assigning a price tag to your product or service, and then learn how to implement a business finance monthly budgeting and cash allocation system —- so you feel in control of what’s coming in and out.

This way, you can step into your self-worth, successfully sell your work, and create a simple system to manage your finances correctly.

All without putting your head in the sand about your income and expenses, shying away from marketing yourself, and defaulting to old patterns that leave you wondering “will I ever figure this out?”

You probably already know this…

If you’re a business owner or on the brink of starting your own thing, then you likely know you need to say “goodbye!” to the pesky money stories whispering: “You should give your services away for free” or “Who do you think you are to charge for this?!”

You likely also aware that transforming your relationship with money and building solid financial systems (for both business and personal finances) is the key tipping point that will allow you to create ease around your business — meaning, receiving revenue from customers, allocating cash, and having a monthly budgeting system so you feel in control about what’s coming in and going out.

In addition, maybe you have negative stories around personal finance that you’d like to shift. Like: “I can’t make money doing what I love” or you subconsciously subscribe to the “More money more problems” narratives because you’re nervous about taxes and expenses.

Managing finances is an unavoidable part of life — and commerce.

Money is required for you to live your most authentic life. Whether that’s registering for a half marathon or saving up for the down-deposit on your San Diego beach bungalow with a chicken coop.

Handling money is also a key aspect of commerce. That means, not stashing cheques in the drawer when the invoice payments arrive. But, learning how to truly manage your business finances - like having separate bank accounts, being proactive about cash allocation, budgeting, setting aside money for taxes, and paying yourself.

This course will help you improve your personal relationship with money and your business systems.

But, here’s the info you might be missing…

After improving your relationship with money + implementing better systems, you can:

Feel in control of your corporate finances.

With the right mindset, monthly systems, budget plan, you can have a peaceful, easier relationship with money both in your personal life and in your company. Which, leaves you in control when you know what’s coming in and what’s going out. (Even if it’s only $100 in income at the start).

Confidently Charge your worth.

No more discounting your work, accepting clients for free (and justifying that it’s a good experience and a potential testimonial), or slashing your prices when people say they can’t pay your full rates. It’s great to have accessible price options — always encouraged! — yet if you never let people pay you properly when they can, then it’s hard to financially make a company succeed. Which, is a disservice if the company goes under.

say no to income streams that don’t light you up

If you’re still holding on to other income sources just for the income (even though it makes you wanna hurl), then transforming your relationship with money can help you release the fearful death grip to your desk job or side-hustle working for Scrooge. Or, if you already have a company, then you can let go of the clients you dread seeing in your calendar and make space for more aligned ones.

overcome your fear of marketing + Sales

Do you feel gross “asking” for money? (AKA: sales?) Do you dread writing an email newsletter and promoting your offer? Do your palms drip with sweat by just the thought of having a consult call with a potential client? If you have a deep aversion to putting yourself out there and selling, then you may have a money mindset block since you’re not seeing your own value.

Confidently invest in the right help, Systems + GEar.

Need your first employee but afraid to outsource? Desperately need a new computer to edit videos faster, but it’s a few grand? When you more peaceful relationship with money, you’ll feel comfortable investing in yourself without pulling out hair when it comes down to making a big, financial decision.

Even though it seems obvious, the process of transforming your relationship with money is anything but.

Feel more peace around finances + implement better systems?

Great!

But where do I start?

Perhaps you’ve committed to starting.

You’ve journaled in a notebook about the stories you learned about money growing up or read a money book (while secretly hiding the cover).

If you’re super committed to reaching your next level, you’ve purchased books and enrolled in classes assuring yourself that “this will totally solve the problem.”

But, even with the best of intentions, most small business owners fail to venture into the real problem.

Why people have a hard time making progress:

If you prefer to avoid money, then doing the money mindset work and implementing strong financial systems in your business is…. something you are likely avoiding too. Ultimately always putting it off until “someday.”

Or, maybe you are good being aware of your limiting beliefs and patterns… but when you are met with the choice of hiring an employee or in your personal life, splurging for the almond butter you really love… you fall right back to your old money mindset and succumb to the same stories. You forgo the employee or the creamy almond butter that would have been just the right amount of crunch and salt on your toast. (This course focuses on business and personal finances, since you likely have similar habits for each).

Or, perhaps you don’t “think” focusing on money is important. Yet, money is a key aspect of commerce - taxes, payments, invoices, expenses, and balance sheets. Thinking that money isn’t important is the exact same thing as thinking that flossing and brushing are irrelevant. Feels great in the moment to avoid what’s pesky, but it isn’t cool when you’re stuck in the dental chair with a thousand dollar bill and a sore jaw.

That’s why it’s good to take smart actions now and get your systems in order. Like your teeth, it’s never “too late” or “too soon” to start a good flossing habit.

5 Reasons Why Most Financial Habits Fail

(and how to make sure yours stick).

1) You don’t know what’s lurking in your subconscious mind

For example, you might find yourself saying “I don’t have time to start a side hustle selling my organic candles” But, after doing the money mindset work you’ll uncover the deep-seated belief is actually “I’m not good enough.” It’s the real why behind your stuckness. Uncovering those pesky buggers is what makes it mindset work transformational versus a band-aid fix that only works until you’re faced with a new challenge… and you default to old patterns. If you don’t ditch the bottom belief, then you’re always stuck in the same self-destructive loop - like earning money and then spending it all, being in financial in “feast or famine” mode, or staying in misaligned work.

2) You have a hard time implementing financial systems.

Maybe you’ve flipped through the pages of a money mindset or financial book. That’s great. But, once you’re done skimming the pages, now what? Are you implementing it? Most people struggle with implementation and that’s why you need a plug-and-play guide. When it comes to systems that stick, the implementation (rather than pure knowledge) is everything.

3) You “get it” but when faced with a challenge, you back down + let excuses win

Maybe you think you’ve made the decision to change, but the second it gets uncomfortable to fling yourself out of your comfort zone… you freeze in your tracks and stop right there. Then, succumb to a sea of excuses like: “not right now” and “maybe later” and “it’s not flowing well, so I’ll just stop.”

4) You don’t have step-by-step instructions on elevating your self worth

Everyone talks about the importance of having high self-worth, but nobody teaches you how. How do you find it? And then, uphold it in conversations where someone wants to hire you at 50% off what you normally charge? Learning how to elevate your worth with precise steps is what makes meaning change.

5) You feel shame and shadow around money

Maybe you don’t like talking about it, talking about revenue with fellow business owners feels “taboo,” or you’re embarrassed that your small business is still in a very early stage with little income trickling in. (That’s ok!) Everyone has shame around money, frustration, and shadow. Yet, it’s how you release it that matters so that you don’t have it holding power over you.

If you’re ready to overhaul your business finances + feel more relaxed, here’s how we’ll get you there….

INTRODUCING

Your Money Mindset

with Kelly Trach

Your Money Mindset

is the only course of its kind that emphasizes the following…

PINPOIN the hidden BELIEFS holding you back

Figure out what narratives have been subconsciously on repeat and learn to re-write a better money story for yourself that belongs to you (not your family or friends).

SET UP EASY FINANCIAL BUSINESS SYSTEMS.

When I was a young business owner, I had one business bank account with all cash flow going in and out of it. I hated opening up credit card bills. Money made me nervous. I was consistently worried I would report something wrong for the goverment. When I got the systems in place, that I will illustrate in this course — banking, bookkeeping, accounting, budgeting, and personal finance — I could sleep at night knowing that if I needed a new computer for $2,000, I could afford one. Or, when taxes were due, I could pay for them from the dedicated account for which I saved for them all year.

LEARN HOW TO BUILD A SIMPLE COMPANY BUDGET YOU CAN FOLLOW

So that you move at the rate of cash flow. Meaning, if you make more money, then budget goes up. This way, you can build a company more sustainably. Slow and steady is best!

instructions to ELEVATE Self-worth

With the support of this course, you’ll be able to turn down subpar requests like opportunities that aren’t the right fit or perhaps work towards leaving that 9-5 at the oil and gas company and start consulting for clean, green tech instead.

Learn to say no, negotiate + stop settling

Discover holding you back — is it that you think you’re not good enough? Not talented enough? Joe’s Coffee Shop will always be cooler than yours? Uncover what’s lurking in your mind and learn how to shift those thoughts. Enrolling in this course is the difference between tossing a dart and hitting the edge of the board versus right in that juicy center spot.

IMPLEMENTING it into your everyday DECISION making

I don’t want you to just know the money mindset work, but to live it. Yes, there is self-reflective journaling and setting up monthly business financial systems. But, it’s also the practice of saying “Sorry, no. These are my rates!” when the big corporate company wants your workshop for half price.

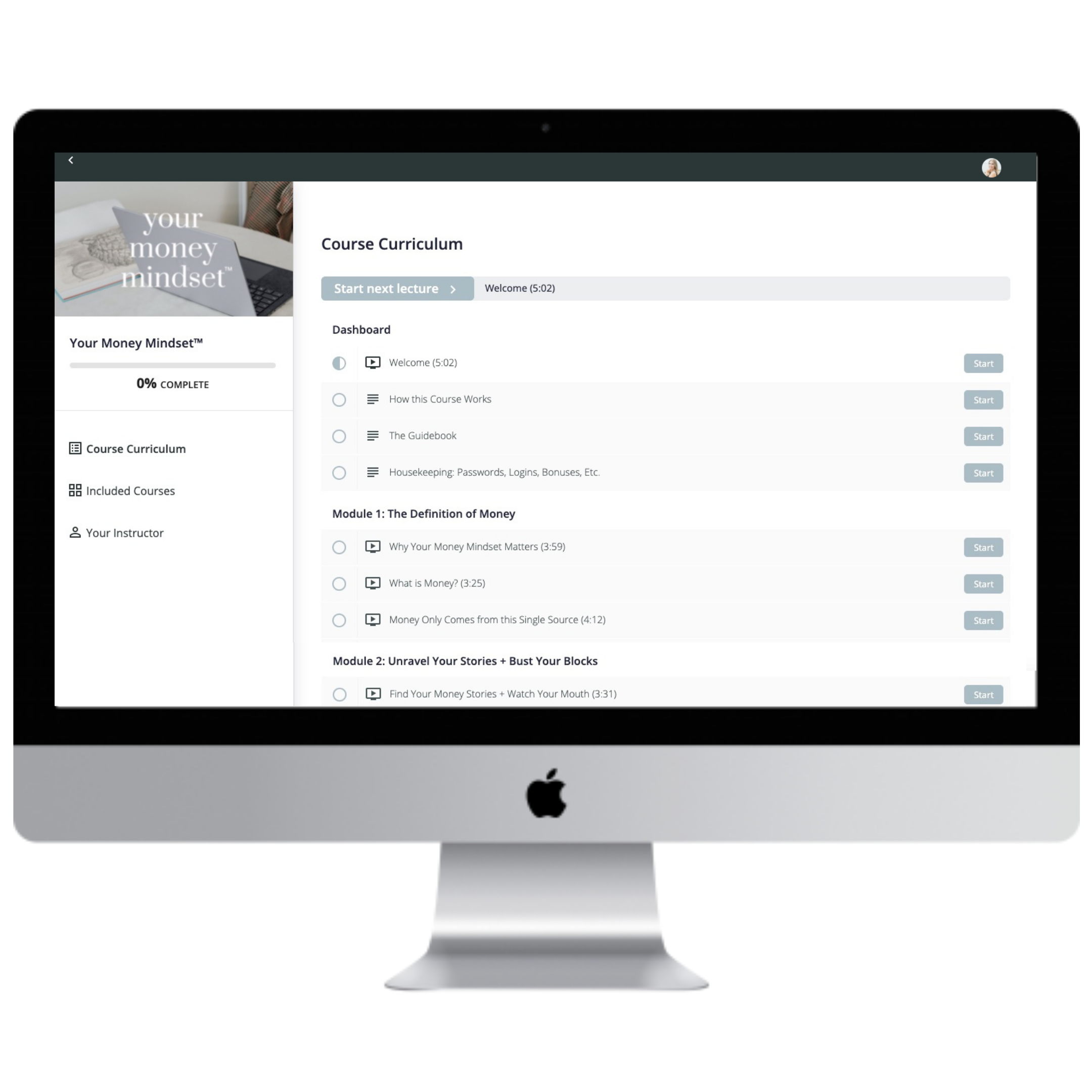

curriculum

What Students Are Saying

“After listening to module 3 on self-worth, I realized that with my low paying jobs I was not owning who I am. So, I just took a huge leap, resigned + quit a job. It’s truly liberating to know that by doing this, I’m creating energetic space and time for my own business to manifest.”

Julianne Nieh

"Wow, I had no idea about the negative beliefs I've been holding on to. I never explicitly believed (or was told) that money was evil or dirty, so I went in thinking I would have a head start. Turns out, there was all sorts of other gunk in there was subconsciously calling the shots."

Noelle Menigoz

“I began working with a financial advisor. I was putting off transferring my accounts + working with an advisor for nearly two years. Now, I finally switched my accounts to actually invest + I bought a condo after completing your course."

Francesca Rose

What’s Included

42 Video Trainings

All recorded so you can listen again, pause when needed, and take notes. Dedicated lessons to guide you, teach you tools, and enable you to reach the goals you’ve been seeking.

24-Paged Printable Guidebook Designed to Help You Re-Write Your Money Story

Jam-packed with takeaways, journaling prompts, and space for your to re-write your money story and discover your hidden patterns. These are precisely the same questions I would give during a one-on-one session.

24/7 Lifetime Access

Hop on to the online platform or the app and listen on-the-go. Your course materials are there forever and you can listen anytime.

$297

FAQ:

What does self-study mean? It's all pre-recorded and packaged up for you so you can take the class at any time and go at your own pace.

What is the time commitment for this course? You only need 1-hour per week. If you wanted to do it all at once, you could finish the course and set up all the systems in a weekend over a good cup of coffee. And maybe a nice muffin. The videos are all < 5 minutes each — it’s intentionally designed so you implement the learnings.

Can I get a refund? This course is final sale. Here are the terms + conditions.

Your Money Mindset is perfect for you if:

You have no business budget in place or no cash allocation strategy.

But, you’d love one. Right now, the “business stuff” makes your palms sweat. You don’t know how to set aside money for taxes, expenses, or even paying yourself.

You are in A rut

You have all the drive and talent, offer spectacular things, and are truly excellent at what you do…. but the money part of your business isn’t jiving. And, when you look at successful folks, you wonder: “What the heck do they know that I don’t?”

your self-worth could use an upgrade

Perhaps you feel like you are “playing small.” Or, maybe you your company is up and running, but you’re working for pennies, not charging enough, or shying away from marketing because it makes you uncomfortable.

You have a hard time marketing your work + sharing it publically

The idea of you “selling” or “promoting” your small business feels “cheesy,” “gross,” or “slimey.” (We can change this — your work deserves to be seen!)

Every decision comes down to the cost

This could be a drip coffee versus a latte in your personal finances or forgoing a tech platform that’s $2,000 per year because you want to “DIY it,” even though it would free up a lot of your time. The story of “I’m afraid to spend money” might be holding you back from getting the gear, professional guidance, or necessary business investments you deserve to move forward.

The phrase “business finances” makes you want to hide

It feels overwhelming and hard. Perhaps, making you question the potential of running a small business.

you secretly BELIEVE your goals aren’t possible

Perhaps you see other entrepreneurs and you think: “Oh, I can’t do that.”

You have a confusing, polarizing relationship with money

You love it, you hate it, you’re scared of it, and you want more, but you’ll never admit it. It’s an up-and-down relationship with a ton of tears, fury, and frustration. But, when you do get your hands on meaningful income you’re like: “OMG YES! I LOVE YOU!”

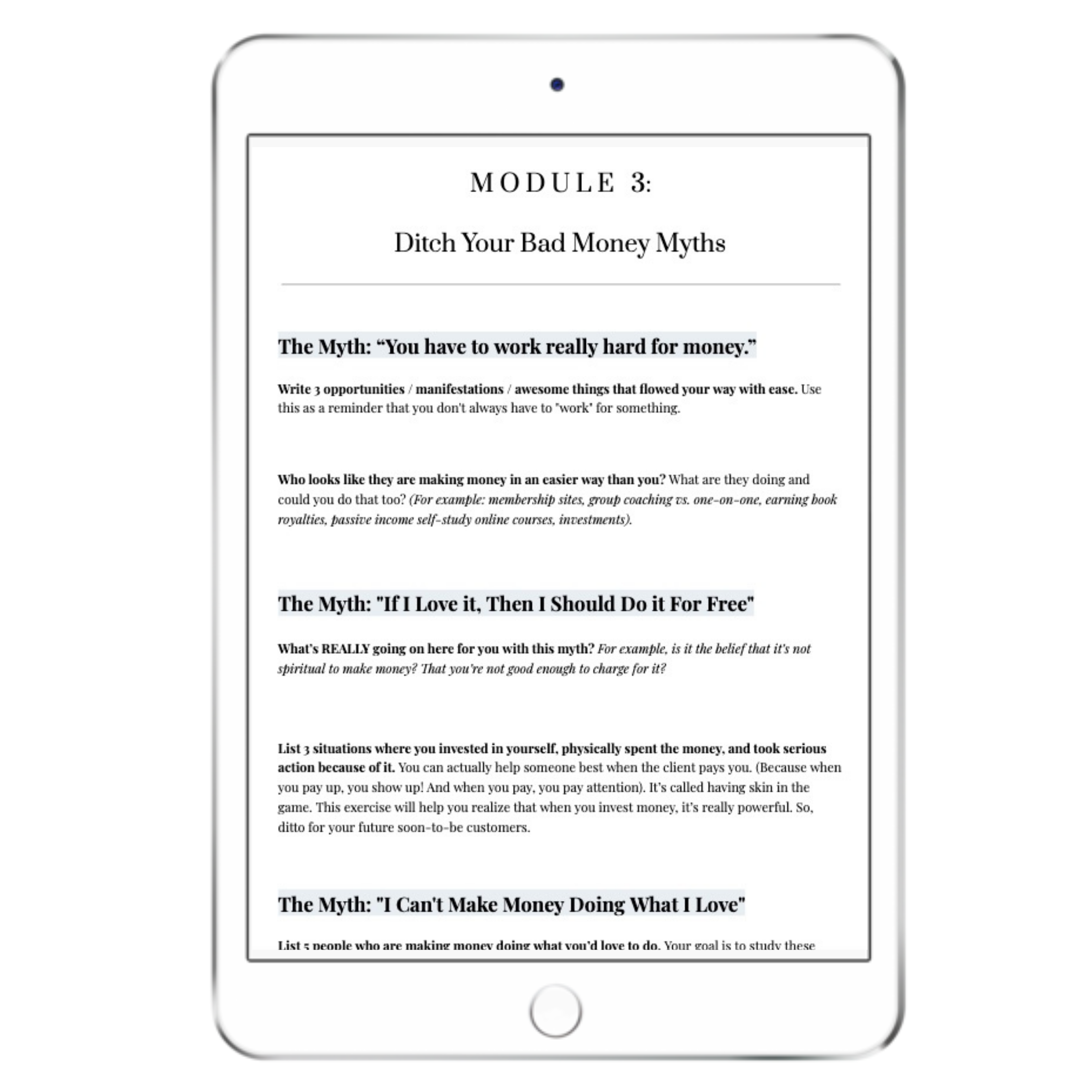

Your current Mindset is Self-sabotaging

Phrases like: “I have to work really hard to make money” get the best of you. Or perhaps you think: “If I love this, then I should do it for free instead of charging for it.” And maybe you hold yourself back from opening a small business because you wonder: “How will I ever manage it?”

If you nodded your head to at least 5 items above….

Then I’m incredibly excited to see you inside Your Money Mindset. You’re the exact person I could support with these tools and teachings.

Included Bonuses

get 4 FREE bonuses worth $300

The 11 Biggest Self-Sabotaging Money Habits and How to Reverse Them. This video class illuminates where you might be destroying your own success and teaches you how to reverse the patterns that are keeping you secretly stuck. If you’re ready to kick those bad beliefs and blocks for good, then you’re in the right place.

(Value: $100)

A Meditation to Own Your Worth. A 13-minute guided meditation experience to help you remember your innate worth and witness your own deservingness so that you stop settling.

(Value: $50)

Daily Declarations to Transform Your Relationship with Money. If you’ve ever struggled and wondered: "how do I make time to work on my money mindset when I already have a full plate?" Then, this bonus will be your ultimate shortcut to stepping into your worth and shifting your mindset with a better money story.

(Value: $50)

The Ultimate Guide to Manifesting Money in Your Business. With this video course, you’ll discover how to call in new clients, opportunities, and income into your business.

(Value: $100)

You’ll have immediate access to all of them when you enroll so you can hit the ground running!